Average private student loan interest rates remain low, data shows: How you can lock in a good rate

Private student loan rates are different from federal student loan rates because they can vary depending on a number of factors. See how you can qualify for the lowest fixed and variable rates on a private loan in this analysis. (iStock)

Private student loans are often used as a way to bridge the college financing gap when federal loans and financial aid come up short. But since they're offered by private lenders and not the federal government, private student loan interest rates can vary widely depending on a number of factors.

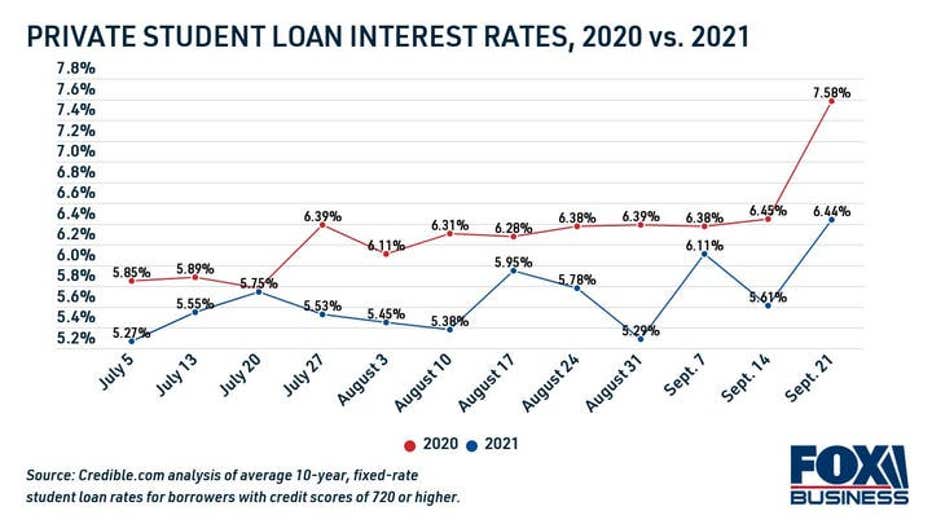

Current student loan interest rates are relatively low compared to the same time last year, according to data from Credible. While interest rates on 10-year, fixed-rate private student loans tend to spike at the beginning of the academic year, they rose to a lower rate than they did in 2020.

BEST GRADUATE STUDENT LOANS OF FALL 2021

Interest rates on 5-year, variable-rate private student loans are also on par with where they were this time last year. During the second week in September 2020, the average rate on variable-rate loans was 3.39%, compared with 3.19% for the same week in 2021.

Keep reading to learn how you can lock in a low private student loan rate and save money on your college financing plan. You can browse student loan rates from real private lenders in the table below.

FAFSA APPLICATIONS FOR THE 2022-23 SCHOOL YEAR OPEN OCTOBER 1

How to get a good private student loan interest rate

Federal student loans have fixed interest rates that depend on the type of loan you borrow and when you borrow it. But private student loan interest rates can vary based on a number of factors, such as a borrower's credit score, the loan amount and the length of the repayment term.

Here are a few ways to make sure you get the lowest possible private student loan rate for your situation.

HERE'S WHY VARIABLE INTEREST RATE STUDENT LOAN REFINANCING MAY BE A SMART MOVE

Find a creditworthy cosigner

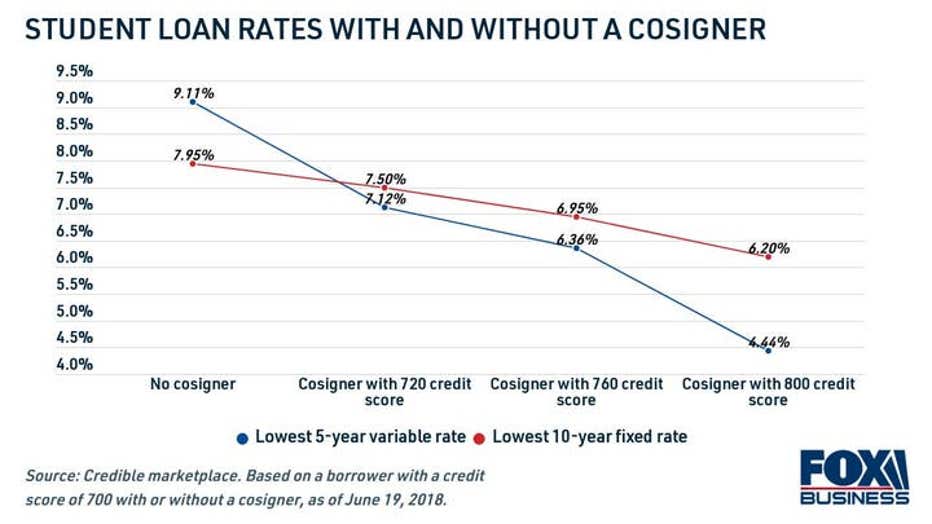

Student loan rates are based in part on the borrower's creditworthiness, but many rising college students haven't had the chance to build a decent credit history before going off to college. That's why many student borrowers rely on a cosigner to get a lower interest rate.

A recent Credible analysis found that student loan borrowers with a credit score below 620 were able to lower their rate by 4 percentage points on average by adding a cosigner. The amount you can save depends on the credit score of your cosigner.

Before asking someone to cosign on your student loans, get a clear picture of the annual percentage rate (APR), student loan fees and repayment examples. You can see student loan rates and repayment options on Credible without impacting your credit score.

BIDEN ADMINISTRATION ISSUES 'FINAL EXTENSION' OF STUDENT LOAN DEFERMENT

Shop around with multiple lenders

Because private loan interest rates vary depending on the lender, it's important to compare offers from multiple lenders to make sure you're getting a decent rate.

Most private student loan lenders let you check your estimated interest rate with a soft credit check, which won't hurt your credit score. This way, you can choose the best offer for your situation before you apply — typically the one with the lowest APR.

Well-qualified borrowers may be able to save more than $5,000 on their student loan debt by comparing student loan interest rates before choosing a lender, according to a Credible analysis.

You can compare student loan repayment plans on Credible for free.

WHAT TO DO IF YOU DON'T QUALIFY FOR $9.5B WORTH OF STUDENT LOAN FORGIVENESS

Sign up for an automatic payment discount

Select online lenders will offer a lower interest rate if you sign up for direct payments that are automatically deducted from your bank account. An autopay discount can be a good way to lower the amount you pay in interest all while making sure you never miss a student loan payment.

FEDERAL STUDENT AID PREPARES FOR 'UNPRECEDENTED TASK' OF RESUMING LOAN PAYMENTS AFTER FORBEARANCE

Have a finance-related question, but don't know who to ask? Email The Credible Money Expert at moneyexpert@credible.com and your question might be answered by Credible in our Money Expert column.