Businesses across US request ‘exact change’ amid coin shortage caused by COVID-19

LOS ANGELES - Following an announcement from The Federal Reserve last month that the coronavirus pandemic has created a shortage in coins in the U.S., businesses around the country have been urging their customers to use alternative forms of payment or bring exact change.

In early June, the Federal Reserve said, “The COVID‐19 pandemic has significantly disrupted the supply chain and normal circulation patterns for U.S. coin.”

“To ensure a fair and equitable distribution of existing coin inventory to all depository institutions, effective June 15, the Federal Reserve Banks and their coin distribution locations began to allocate available supplies of pennies, nickels, dimes, and quarters to depository institutions as a temporary measure,” the Federal Reserve said.

On Thursday, popular Philadelphia convenience store chain Wawa asked its customers to either pay with credit or debit cards, mobile app or exact change amid the recent currency shortages.

RELATED: The cost of COVID-19: Amid illness, Americans face heavy financial burden in testing and treatment

FOX 29 Philadelphia also reported that Wawa is giving its customers the opportunity to round their purchases up to the nearest dollar and donate the difference to the Wawa Foundation. All proceeds will be given to local charities supporting causes related to health, hunger, everyday heroes and local chapters of the USO, according to the company.

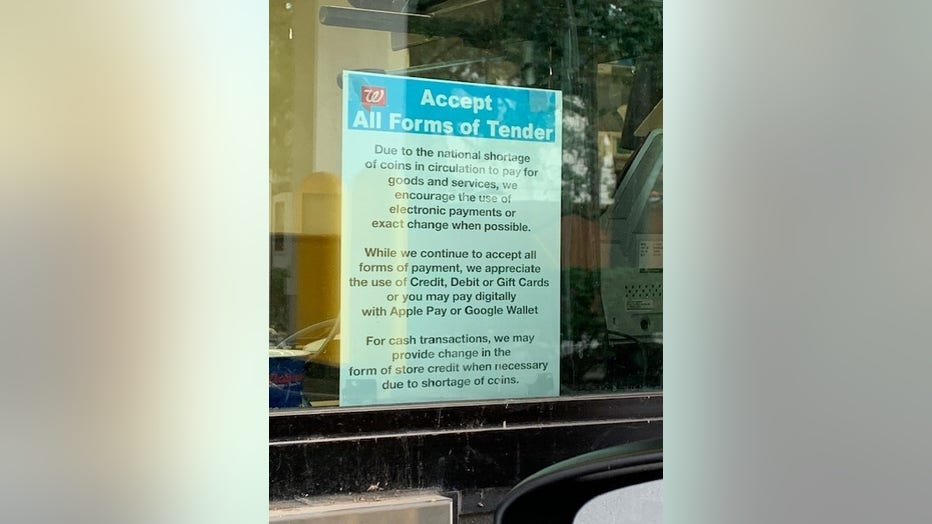

And in Houston, a local Walgreens displayed a sign encouraging customers to avoid using cash or to carry exact change.

“While we continue to accept all forms of payment, we appreciate the use of Credit, Debit or Gift Cards or you may pay digitally with Apple Pay or Google Wallet,” the sign read.

Sign at a local Walgreens urges customers to use 'exact change' amid a national coin shortage.

Speaking during testimony before the House Financial Services Committee on June 17, U.S. Federal Reserve Chairman Jerome Powell said that the shutdowns caused by the pandemic had raised concerns about circulation of coins, which the Fed's 12 regional banks are in charge of supplying to commercial banks.

“With the partial closure of the economy, the flow of funds through the economy has stopped,” Powell said. “We are working with the Mint and the Reserve Banks and as the economy re-opens we are starting to see money move around again.”

The current coin shortage is not the only reason businesses are requesting other forms of payment, however.

A growing number of businesses and individuals worldwide have stopped using banknotes in fear that physical currency, handled by tens of thousands of people, could be a vector for spreading the novel coronavirus.

RELATED: US economy may be stalling out as viral outbreak worsens

Public officials and health experts have said that the risk of transferring the virus person-to-person through the use of banknotes is low, but that has not stopped businesses from refusing to accept physical currency, and some countries from urging their citizens to stop using banknotes altogether.

“In many areas, cash was already beginning to disappear due the increased risk of robbery, the ease of internet ordering, and the ubiquity of cell phones,” says Zachary Cohle, an assistant professor at the department of economics at Quinnipiac University in Connecticut.

“Cash,” Cohle said, “now carries an extra stigma.”

The presence of live virus particles on banknotes does not necessarily mean they are a health hazard, public health experts have said. Virus particles are unlikely to return to the air, or aerosolize, once on a surface.

“It’s not impossible that there might be traces of virus on dollar bills but if you wash your hands it should provide adequate protections, you shouldn’t need anything else,” said Julie Fischer, a professor at the Center for Global Health Science and Society at Georgetown University, on C-SPAN in March.

The Associated Press contributed to this story.