College tuition is up 33% since 2000: How to cope with rising costs

The cost of college tuition has ballooned in the past two decades, and it's causing students to take out more debt than ever. Here's how to save money on student loans amid rising secondary education costs. (iStock)

Student loan debt is a burden that weighs more heavily on today's college graduates than any generation that came before them. With the rising costs of higher education and wages that don't track with inflation, young Americans are struggling to save for financial milestones like buying a house.

But despite rising college costs, students are optimistic about their financial futures, according to a May 2021 survey from AIG. Three in five college students say they are prepared to manage their money, and their salary expectations have increased, as well.

If you or someone in your family is considering going to college, it's important to find ways to cut costs as a way to cope with rising tuition and college debt, from applying for scholarships to shopping around for the lowest student loan rates for your situation. Visit Credible to learn more about student loans and compare interest rates across lenders.

7 OF THE BEST PRIVATE STUDENT LOANS IN 2021

Why are college tuition and student debt rising?

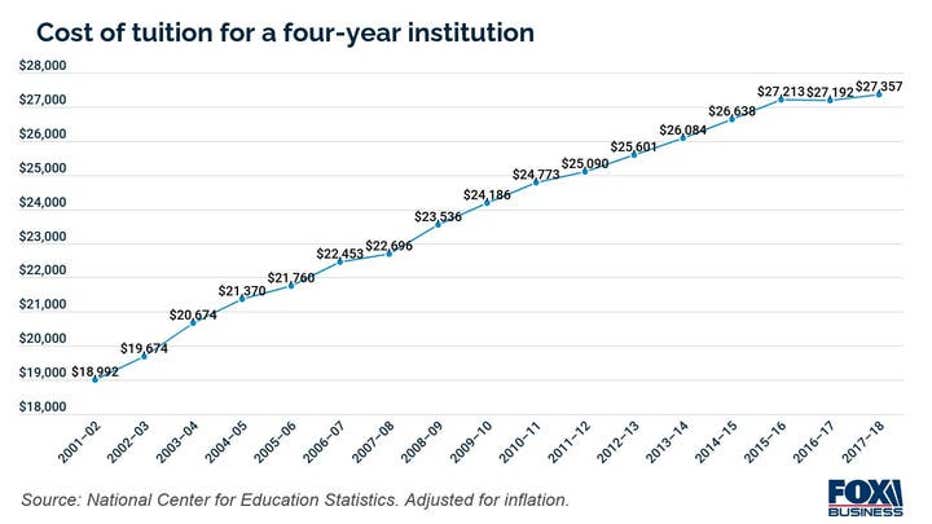

A college education is becoming more expensive than ever before. Tuition has increased 33% from $18,992 in the 2001-02 school year to $27,357 for the 2078-18 school year, per data from the National Center for Education Statistics.

Here are a few things that are contributing to rising college costs:

- State funding for higher education is falling. Between 2008 and 2018, states spent 41% less per student on public higher education. Students and their families are tasked with making up the difference.

- High school graduates tend to overvalue the return of college degrees. The No. 1 reason why students aspire to earn a college degree is to improve their earnings potential, explains the "Golden Ticket" theory. But with rising college costs, the return on investment may not be worth it, depending on the amount of debt that needs to be taken out for the degree earned.

- Demand for a college education continues to rise. Although enrollment is slightly down since its peak at 21 million in 2010, it's increased by 5.9 million between Fall 1990 and Fall 2020.

As a result of rising tuition costs, college students have to borrow more money to pay for their education. Outstanding student debt more than tripled between 2006 and 2021, from $481 million to $1.74 trillion, per Federal Reserve data.

WHY COLLEGE TUITION AND FEES ARE RISING FASTER THAN FINANCIAL AID

How to cut college costs amid rising tuition

While the current climate for college tuition and student loan debt may seem bleak, that won't stop high school graduates from seeking higher education. If you're trying to figure out how to pay for college amid a record-high price tag, but you don't qualify for grants and scholarships, consider these tips for cutting costs.

Shop around to compare student loan interest rates

When borrowing money to pay for college, you have two options: Federal student loans and private student loans.

Federal student loans are backed by the Department of Education. They have low, fixed interest rates and offer forbearance, deferment, and income-driven repayment plans, all of which can help borrowers who can't afford to pay their loans right out of college.

Private student loans are offered by banks. They typically have fixed interest rates, which are currently low. Borrowers with good credit will be eligible for the best student loan rates.

For many borrowers, federal student loans will be the best choice. But it's still important to explore all your options before you borrow. You can compare private student loan rates without affecting your credit score on Credible's online marketplace.

Take advantage of the low cost of community college

Community college comes at a low cost, and it might be even cheaper in the future. President Biden included free community college in his newest budget proposal, which hasn't made it through Congress as of publishing.

Aspiring college students could consider attending a community college for a few years and then transferring to a four-year institution to save money.

Some community colleges even offer classes to students who are still enrolled in high school, giving them a chance to earn college credits before filling out university applications. Plus, don't forget about enrolling in Advanced Placement (AP) courses while in high school to earn college credits.

5 COLLEGE EXPENSES YOU SHOULD BUDGET FOR

Refinance your student loans for a lower interest rate

Already have student loans? Now is a good time to refinance to a lower rate. 10-year private student loans hit a record-low rate during the week of May 17, 2021 dropping to 3.56%. Take advantage of a student loan refinancing calculator to see how much you could save with a lower interest rate.

If you're looking to refinance your student loans, compare potential interest rates across multiple lenders at once on an online marketplace like Credible. This can help you shop around for the lowest possible interest rate for your situation.

Borrowers with federal student loans may want to think twice before refinancing their loans, though. Refinancing to private student loans means you'll lose federal protections like deferment, forbearance, and maybe even student loan forgiveness.

BIDEN'S BUDGET EXCLUDES STUDENT LOAN FORGIVENESS

Choose a career with student loan forgiveness

College graduates who are employed by a federal, state, or local government or nonprofit organization may be eligible for Public Service Loan Forgiveness. This program forgives the remaining balance of your federal student loan debt after you've made 120 qualifying monthly payment plans while working full-time for a qualifying employer. According to the AIG study, 44% of students will try to qualify for a student loan forgiveness program.

Not all borrowers will be eligible for this type of loan forgiveness, though. And since federal student loan debt forgiveness is becoming less likely to come to fruition, it may not be worth it to wait around for forgiveness measures while your student loan debt accrues interest.

To figure out how to pay for college or what you should do with your student loans, get in touch with an experienced loan officer at Credible.

CONSIDERING REFINANCING YOUR STUDENT LOANS? WHAT TO KNOW

Have a finance-related question, but don't know who to ask? Email The Credible Money Expert at moneyexpert@credible.com and your question might be answered by Credible in our Money Expert column.