Families are using the child tax credit to pay off debt, Census Bureau finds

The future of the child tax credit hangs in the balance as the Biden administration struggles to pass the Build Back Better bill, which would extend the benefit through 2022. (iStock)

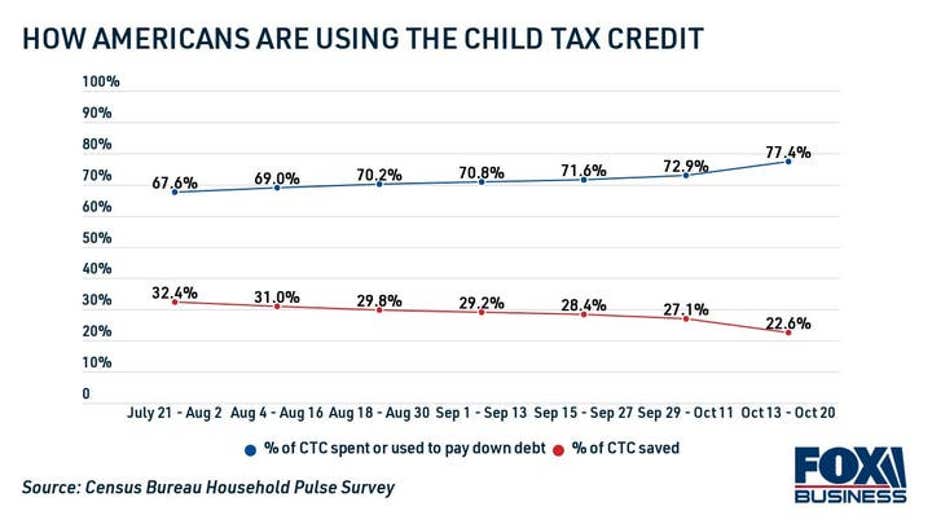

The expanded child tax credit (CTC) payments have been a lifeline for many American families during the coronavirus pandemic. The vast majority (77%) of beneficiaries have been using the $300 monthly payment for household spending and paying down debt, according to Census Bureau data.

The Build Back Better Act would extend this benefit through 2022 and make the credit permanently available to low-income families. But as President Joe Biden's signature social spending bill lingers in Congress, the future of CTC payments is unknown.

Keep reading to learn more about how Americans are utilizing the child tax credit, and learn more about your alternative debt repayment options if the CTC isn't extended. You can visit Credible to compare interest rates on debt consolidation loans for free without impacting your credit score.

HOW YOUR TAX RETURN CAN IMPROVE YOUR CREDIT

More households are using their child tax credit than saving it

The American Rescue Plan, which was signed into law by President Biden in March 2021, increased the child tax credit amount and automatically distributed the credit in monthly payments ranging from $250 to $300 per eligible child. Millions of American families qualified for the full amount, with income caps of $150,000 for married couples and $112,500 for single-parent households.

When families began getting advance payments in July, about two-thirds (68%) of them used the CTC payment to supplement spending or pay down debt, while a third (32%) were able to save the money, according to the Census Bureau Household Pulse Survey. As time went on, fewer families were able to put the credit into savings — less than 1 in 4 (23%) beneficiaries could save the money, while the vast majority (77%) spent the CTC payment.

5 REASONS FOR TAXPAYERS TO FILE TAXES EARLY

Low-income families are even more dependent on the expanded credit. Recent research from the Center on Budget and Policy Priorities (CBPP) found that 91% of households with incomes below $35,000 rely on the CTC payments to cover basic expenses, such as food, shelter and education. The CBPP also found that making the expanded CTC permanent would reduce child poverty by more than 40%.

However, the final CTC payment was distributed in December, and it won't continue in 2022 unless lawmakers can come together to pass the Build Back Better Act. The $1.7 trillion spending bill needs the support of every Democrat in the Senate in order to pass without Republican support, but it was stalled beyond its original Christmas deadline when moderate Sen. Joe Manchin of West Virginia pulled support for the legislation.

If you've been relying on the child tax credit to pay down debt, you may have to seek alternative debt repayment methods in the New Year as the future of CTC payments is unclear. You can learn more about paying off debt by getting in touch with a knowledgeable loan officer at Credible.

MILLIONS WON'T GET FULL COVID-19 ECONOMIC IMPACT PAYMENT

How to pay off debt without CTC payments

High-interest debt is a heavy financial burden that can make it difficult for families to afford other necessary expenses like child care, rent and utilities. If you're struggling to pay down debt without the child tax credit, consider a few alternative debt payoff strategies:

- Nonprofit credit counseling. A credit counselor can analyze your finances to help you create a budget through free financial education. They may also enroll you in a debt management plan (DMP) to repay what you owe, and they may be able to negotiate with your creditors to settle the debt for less than what you owe or reduce your interest rates. Some services from the credit counseling agency may come at a low cost.

- Debt consolidation loans. This is a type of unsecured, lump-sum personal loan that's used to repay high-interest debt like credit card balances and payday loans. You'll repay your debt in fixed monthly payments over a set period of time, typically a few years. Personal loan interest rates are currently near record lows, but the rate you qualify for depends on your credit score and debt-to-income ratio, among other eligibility requirements.

- Balance-transfer cards. Borrowers with very good credit may be eligible to move multiple credit card balances onto a new card at a lower interest rate. Some credit card issuers offer introductory 0% APR offers for creditworthy borrowers who open a balance-transfer credit card. Keep in mind that some issuers charge a balance-transfer fee of 3-5% of the total amount being transferred. You can compare balance transfer offers on Credible for free.

If you decide to borrow a debt consolidation loan, it's important to compare offers across multiple lenders to find the lowest rate possible for your financial situation. You can see your estimated debt consolidation loan interest rates for free without impacting your credit score on Credible, so you can determine if this debt repayment method is right for you.

BUILD BACK BETTER PLAN WILL CUT COST OF INSTALLING SOLAR PANELS BY 30%, WHITE HOUSE SAYS

Have a finance-related question, but don't know who to ask? Email The Credible Money Expert at moneyexpert@credible.com and your question might be answered by Credible in our Money Expert column.