3 things borrowers should know about the extended student loan payment pause

The pause on federal student loan payments has been extended from February until May, giving borrowers an additional 90 days to prepare for student loan repayment. Here are 3 things federal student loan borrowers should keep in mind. (iStock)

The Biden administration recently extended the federal student loan payment pause through May 1, 2022, giving eligible borrowers an additional 90 days to prepare for the return to repayment. The decision comes after prominent Democrats "strongly" urged the president to provide additional student loan relief amid the economic impact of the omicron variant.

"Now, while our jobs recovery is one of the strongest ever … we know that millions of student loan borrowers are still coping with the impacts of the pandemic and need some more time before resuming payments," President Joe Biden said in a statement.

During the extended forbearance period, payments are suspended and interest doesn't accrue on select federal student loans. While this is welcome news among borrowers who are unprepared to restart payments, there are a few things to know about the student loan forbearance extension.

Keep reading to learn more about the student loan payment pause, including your alternative debt repayment options like refinancing. You can see your estimated student loan refinancing offers on Credible for free without impacting your credit score.

FSA PREPARES FOR ‘SMOOTH TRANSITION’ OF RESUMING STUDENT LOAN PAYMENTS

1. Not all student loans are eligible for relief

About 41 million Americans have benefited from the federal student loan forbearance period, according to the White House. But the current debt relief measures don't cover borrowers with the following types of student loans:

- Federal Family Education Loans (FFELs)

- Federal Perkins Loans not held by the Department of Education

- Private student loans

For perspective, private loans account for 8.4% of all student loan debt, according to the Education Data Initiative. Private student loan borrowers may have been eligible to enroll in forbearance through their lender, but interest typically accrues during these deferment periods – this causes the principal loan balance to grow. Alternatively, borrowers with private loans could consider refinancing while interest rates are at record lows.

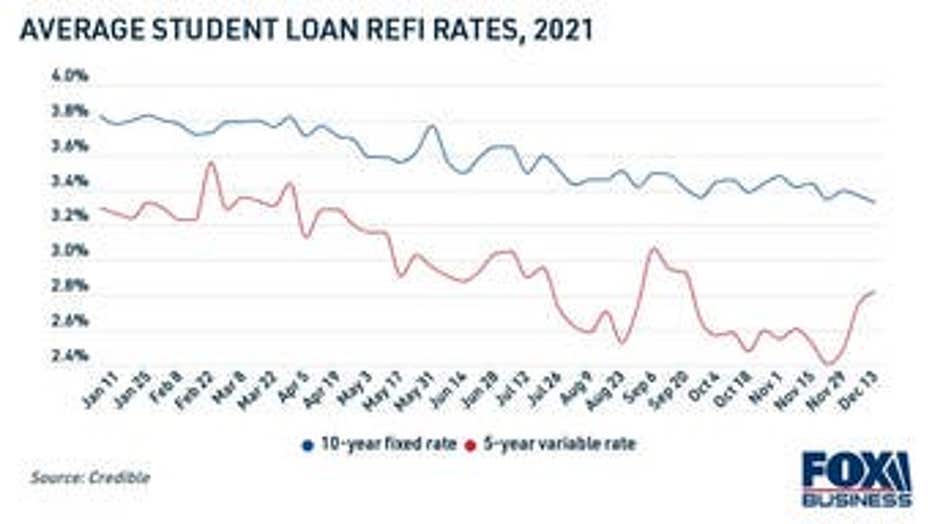

The average interest rate on a 10-year, fixed-rate low fell to 3.33% for well-qualified borrowers during the week of Dec. 13, according to Credible. This is the lowest fixed interest rates have ever been since Credible started collecting this data.

Refinancing to a lower interest rate may help you reduce your monthly payments, pay off your debt faster or save money on interest over the life of the loan. You can begin the application process by comparing student loan refinance rates across multiple lenders on Credible.

WHAT TO DO IF YOUR STUDENT LOAN SERVICER IS SHUTTING DOWN

2. The payment pause counts toward eligible PSLF payments

Student loan forbearance has an added benefit for borrowers who plan to apply for the Public Service Loan Forgiveness program (PSLF). Under this program, public servants who work for qualifying employers are eligible to have the remainder of their federal student loan debt discharged after making 120 qualifying payments.

The months during which payments are suspended count toward the required 120 payments, which means that PSLF applicants will be about two years closer to achieving forgiveness by the time coronavirus aid expires in May 2022.

The Education Department notes that if PSLF borrowers make extra payments toward their debt during the forbearance period, they won't be eligible for PSLF sooner. This means it's more beneficial to not make additional payments in order to maximize the total forgiveness amount.

STUDENT DEBTORS BEGIN TO RECEIVE $2B WORTH OF FORGIVENESS UNDER TEMPORARY PSLF WAIVER

3. Collections and wage garnishment are temporarily stopped

The Education Department has stopped collections activity for borrowers whose student loans were in default before the pandemic. During the forbearance period, the federal government has paused wage garnishment due to unpaid student loan debt.

If you're not current on your federal student loans, be wary of any suspicious collections activities until May 2022. These may be scams by fraudulent debt collectors who want to take advantage of borrowers who are unaware of this student relief measure.

Student loan borrowers who are at risk of defaulting on their private student loans — or their federal loans when forbearance ends — can consider refinancing to avoid delinquency. Borrowers who refinanced to a longer repayment term on Credible were able to reduce their monthly payments by $250 on average, which can make student debt more manageable.

Keep in mind that refinancing your federal student debt into a private loan will make you ineligible for select benefits offered by the Education Department, including income-driven repayment, COVID-19 administrative forbearance and federal student loan forgiveness programs like PSLF.

Browse student loan refinance rates from private lenders in the table below and visit Credible to see your estimated rate and determine if this debt repayment option is right for you.

BIDEN WANTS STUDENT LOAN FORGIVENESS FROM CONGRESS, BUT LAWMAKERS URGE HIM TO USE EXECUTIVE ACTION

Have a finance-related question, but don't know who to ask? Email The Credible Money Expert at moneyexpert@credible.com and your question might be answered by Credible in our Money Expert column.