3 easy ways to cut expenses as eviction moratorium, unemployment benefits expire

With federal COVID-19 protections set to expire soon, you may be looking for an easy way to cut your monthly expenses. Refinancing your loans can save you money every month without having to change your spending habits. (iStock)

The coronavirus pandemic dealt an unforeseen blow to many industries, leaving Americans out of work and without pay. The federal government started a number of financial assistance programs, like increased unemployment benefits and stimulus checks, as well as putting evictions on hold during the pandemic. But as the economy rumbles back to its pre-pandemic state, these protections are set to expire.

The CDC has issued a final extension to the eviction moratorium, giving tenants until July 31, 2021, to get their finances back on track. And about half of the states have cut off the additional unemployment benefit of $300 before the Sept. 6 expiration date, hoping to motivate people back into the workforce.

Still, many consumers are still behind on rent and struggling to make ends meet as we recover from the impact of COVID-19. If you want to get your household expenses back on track, you're probably looking for ways to cut your spending.

There are several ways to cut spending without having to sacrifice necessities like utility bills or food costs. You may be able to save hundreds of dollars every month by:

- Paying off your credit card debt

- Refinancing your private student loans

- Shopping around for cheaper insurance

You can shop around for a range of financial products like loans and insurance on Credible's online marketplace. Doing so can help you drastically cut your monthly expenses so you can become financially stable once again.

HOW DO I BUILD AN EMERGENCY FUND?

1. Pay off your credit card debt at a lower interest rate

Credit cards come with notoriously high interest rates, but millions of Americans still carry credit card debt from month to month. The average American household owes $6,270 worth of credit card debt, according to the Federal Reserve's most recent Survey of Consumer Finances. This translates to hundreds of dollars worth of credit card payments tearing into monthly budgets.

When you make the minimum monthly payments on your credit card, it can feel like you're throwing money at the debt without seeing it decrease. But it's possible to make a tangible debt payoff plan, and even lower your monthly payments, by refinancing your credit card debt with a personal loan.

The average personal loan interest rate is 9.46%, compared to 15.91% for interest-bearing credit accounts, according to the Fed. Since they offer lower interest rates and longer repayment terms, personal loans can help you lower your credit card payment and make room in your budget for other expenses. Let's use an example, assuming the Fed's average interest rates:

- If you're making the minimum payment of about $250 on $6,270 worth of credit card debt, it'll take you more than 11 years to pay off that debt.

- If you refinance to a 10-year personal loan, you can lower your payment to $81 and shave one year off your debt repayment schedule.

This can free up $169 in your budget, which you might be able to put toward back-owed rent or other expenses. Use a personal loan calculator to see your new payment.

9 OF THE BEST DEBT CONSOLIDATION LOANS

2. Refinance your private student loans to lower your monthly payments

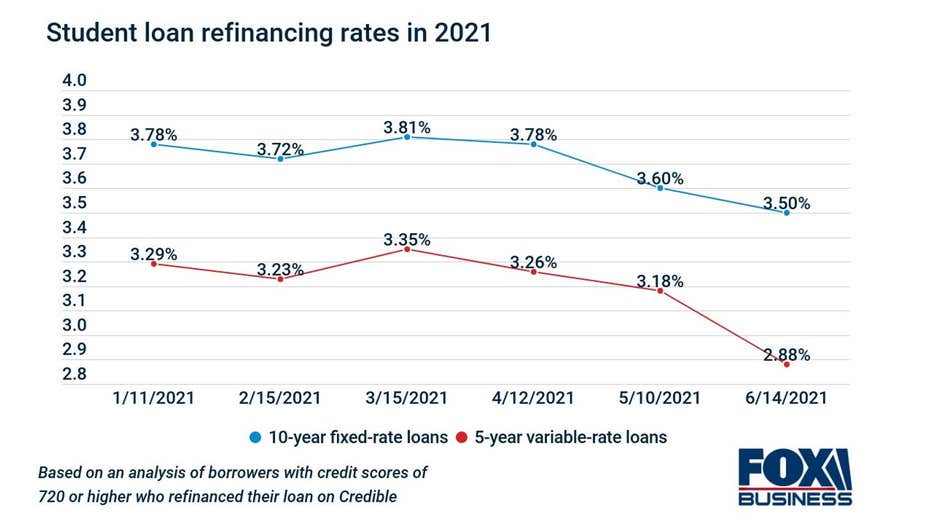

Student loan rates reached record lows in June 2021, which means there's never been a better time to shop around for a lower rate on your private loans.

A lower interest rate may be able to help you lower your monthly loan payments, save money on interest over time or pay off debt faster.

This is particularly true for borrowers who took out student loans several years ago when rates were much higher. Average interest rates were 7.64% in 2018, according to data from Credible. By refinancing your student loans to a better interest rate, you could save hundreds every month, giving you more wiggle room in your budget.

Keep in mind that it's inadvisable to refinance your federal student loans right now, since you'd lose protections like the student loan forbearance moratorium.

Credible's student loan refinance calculator shows you how much you can save on your monthly payment.

5 SUREFIRE WAYS TO PAY OFF DEBT IN 2021

3. Shop around for insurance with a lower monthly premium

One final way to make room in your monthly budget is to shop around for cheaper insurance. You can save up to 30% on your insurance premium if you bundle your home and auto plans, for example. Also consider changing your level of coverage in order to lower your monthly insurance premium, keeping in mind that less coverage means you might be stuck with higher expenses if an emergency occurs.

Shop around for car insurance, home insurance and life insurance plans on Credible. Doing so allows you to compare premiums without affecting your credit, so you can see if you're able to save money on this monthly expense.

THIS IS THE BEST WAY TO LOWER YOUR CAR INSURANCE COSTS

Have a finance-related question, but don't know who to ask? Email The Credible Money Expert at moneyexpert@credible.com and your question might be answered by Credible in our Money Expert column.